ABOUT PFCCO ML

"Uplifting the lives of the Filipinos"

As a member of the Philippine Federation of Credit Cooperatives (PFCCO), we are dedicated to providing accessible, member-focused financial solutions that promote stability and sustainable growth.

Our mission is to build a future rooted in cooperation, trust, and shared progress—empowering communities and strengthening the cooperative movement across the nation.

Total Coops Registered

Total Members Registered

Total Coop Assets

HYMM

HIMIG PFCCO

Team

OUR AMAZING TEAM

Services

FEATURED SERVICES

Business Enterprise

1.) Central Finance Facility

- Share Capital, Savings, Time Deposit

- Loans to Coop Member Fixed Assets & Connectivity Loan

- Additional Capital Loan Services

- Fixed Assets * Connectivity Loan

- Liquidity Loan Services

2.) Cooperative Business Solutions

- Coopbase Comprehensive Accounting System

- Payment & Settlement System (PASS Alliance)

- TM, POS & Others

3.) Cooperative Supplies & Publication

- Cooperative forms

- Passbook

- Ledgers

- Book of Accounts

- Audit Manual

- Accounting Manual

- Internal Control Policy Manual and others

Education & Training

CDA CTPRO NO. 006

PFCCO Mindanao League thru PFCCO National is a recipient of Asian Confederation of Credit Unions (ACCU) several programs:

- CDA Mandatory Training Curricula

- CEO Competency Course

- Audit Competency Course

- Loan Officer Competency Course

- Credit Union Microfinance Innovation (CUMI)

- Asian Development Education Workshop (Asian D.E)

- Professionalization Program for Credit Unions

- Credit Union Benchmarking Services in Elevating for ACCESS BRANDING (CUBSEA)

- Credit Union Directors Competency Courses (CUDCC)

- A1 Competitive Choice for Excellence, Safety and Soundness Branding (ACCESS Branding)

- Credit Union Risk Base Supervision System (CURBSS)

- Stabilization Fund

PFCCO Mindanao League is also a recipient of World Council of Credit Unions (WOCCU) thru Credit Union Empowerment and Strengthening (CUES) several programs:

- CDA Mandatory Training

- Model Credit Union Building

- Institutional Diagnostic for Credit Unions

- PEARLS Monitoring System

- Business Planning, LPAT and other technology

Technical Assistance

- League Governance & Business Center Operation

- CURBES-SIDS

- Access Branding

Projects

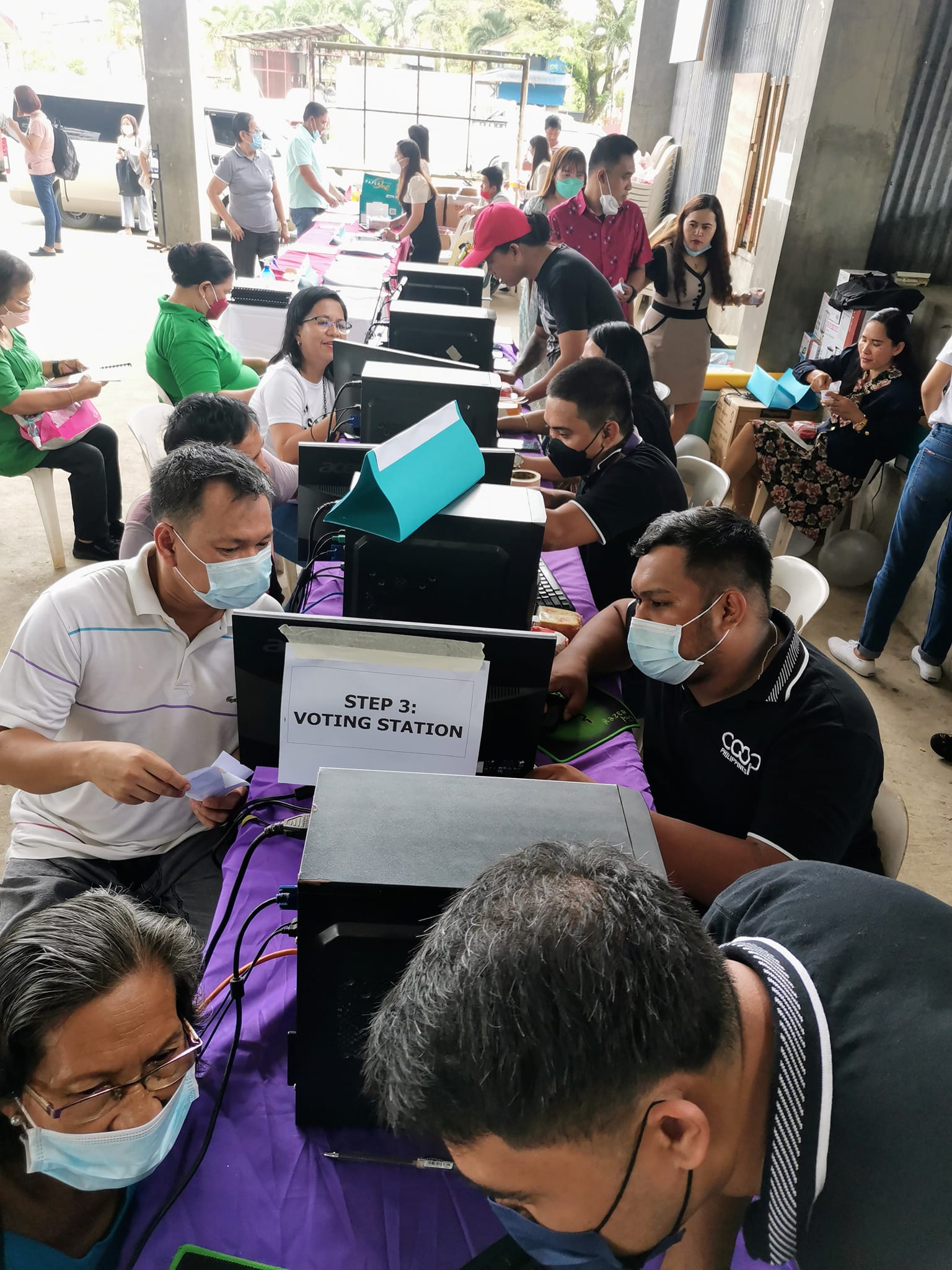

OUR PROJECTS

Want to join us?

REQUIREMENTS

Open to all cooperatives in Mindanao with Savings and Loans operations.

For more details, contact us using details below!

1. Board resolution stating intention to join PFCCO ML.

A formal written statement from the cooperative's board of directors, confirming their intention to become a member of PFCCO Mindanao League.

2. Membership application form.

A completed application form providing the cooperative's essential information, including contact details and membership particulars.

3. List of officers.

A document detailing the names, positions, and contact information of the cooperative's current officers and board members.

4. Most recent audited financial statements.

Certified financial documents that show the cooperative's financial health, including income statements, balance sheets, and audit reports.

5. CDA certification as a registered cooperative.

A certification from the Cooperative Development Authority (CDA) confirming the cooperative's legal registration and status.

6. Minimal membership fee.

Payment of the required membership fee, as specified by PFCCO ML, to activate the cooperative's membership status.

7. Capital investments.

Details regarding the cooperative's initial and ongoing capital contributions, which are essential for membership and financial participation.

Organizations

Affiliations

Mindanao League Offices

CONTACT US

Social Advocacy

Community and Social Involvement